Ways to Give

Online: Click here to make a recurring or one-time gift

By Mail: Make checks payable to Nichols College

Office of Advancement

Nichols College

P.O. Box 5000

Dudley, MA 01571-5000

Tax deduction for charitable gifts

If you itemize deductions on your federal income tax return, you can generally deduct your gifts to qualified charities. This may also help increase your gift.

Example(s): Assume you want to make a charitable gift of $1,000. One way to potentially enhance the gift is to increase it by the amount of any income taxes you save with the charitable deduction for the gift. At a 24% tax rate, you might be able to give $1,316 to charity [$1,000 ÷ (1 – 24%) = $1,316; $1,316 x 24% = $316 taxes saved]. On the other hand, at a 32% tax rate, you might be able to give $1,471 to charity [$1,000 ÷ (1 – 32%) = $1,471; $1,471 x 32% = $471 taxes saved].

However, keep in mind that the amount of your deduction may be limited to certain percentages of your adjusted gross income (AGI). Your deduction for gifts to charity is limited to 50% (currently increased to 60% for cash contributions to public charities), 30%, or 20% of your AGI, depending on the type of property you give and the type of organization to which you contribute. Charitable deductions that exceed the AGI limits may generally be carried over and deducted over the next five years, subject to the income percentage limits in those years.

Make sure to retain proper substantiation of your charitable contributions. In order to claim a charitable deduction for any contribution of cash, a check, or other monetary gift, you must maintain a record of such contributions through a bank record (such as a cancelled check, a bank or credit union statement, or a credit-card statement) or a written communication (such as a receipt or letter) from the charity showing the name of the charity, the date of the contribution, and the amount of the contribution. If you claim a charitable deduction for any contribution of $250 or more, you must substantiate the contribution with a contemporaneous written acknowledgment of the contribution from the charity. If you make any noncash contributions, there are additional requirements.

Year-end tax planning

When making charitable gifts at the end of the year, you should consider them as part of your year-end tax planning. Typically, you have a certain amount of control over the timing of income and expenses. You generally want to time your recognition of income so that it will be taxed at the lowest rate possible, and time your deductible expenses so they can be claimed in years when you are in a higher tax bracket.

For example, if you expect to be in a higher tax bracket next year, it may make sense to wait and make the charitable contribution in January so that you can take the deduction next year when the deduction results in a greater tax benefit. Or you might shift the charitable contribution, along with other deductions, into a year when your itemized deductions would be greater than the standard deduction amount. And if the income percentage limits above are a concern in one year, you might consider ways to shift income into that year or shift deductions out of that year, so that a larger charitable deduction is available for that year. A tax professional can help you evaluate your individual tax situation.

A word of caution

Be sure to deal with recognized charities and be wary of charities with similar-sounding names. It is common for scam artists to impersonate charities using bogus websites, email, phone calls, social media, and in-person solicitations. Check out the charity on the IRS website, irs.gov,using the Tax Exempt Organization Search tool. And don’t send cash; contribute by check or credit card.

What is the Recurring Giving program?

The Recurring Giving program allows you to easily make your gift to Nichols College in regular installments from a credit card or checking/savings account.

How does the program help Nichols College?

Your recurring contributions provide the College with an ongoing, reliable source of funding. Gifts made through this program reduce our administrative costs and allow more of each gift to be used immediately to support Nichols College’s top priorities. These gifts are also “greener” by cutting down on paper, gas and emissions produced by mailings.

How does the program help you?

Enrolling in the program means you won’t have to worry about writing and sending a check, and the number of phone and mail reminders you receive from the College will decrease. If you choose to allow deductions to continue from year to year, you will be counted among Nichols’ most loyal and valued donors.

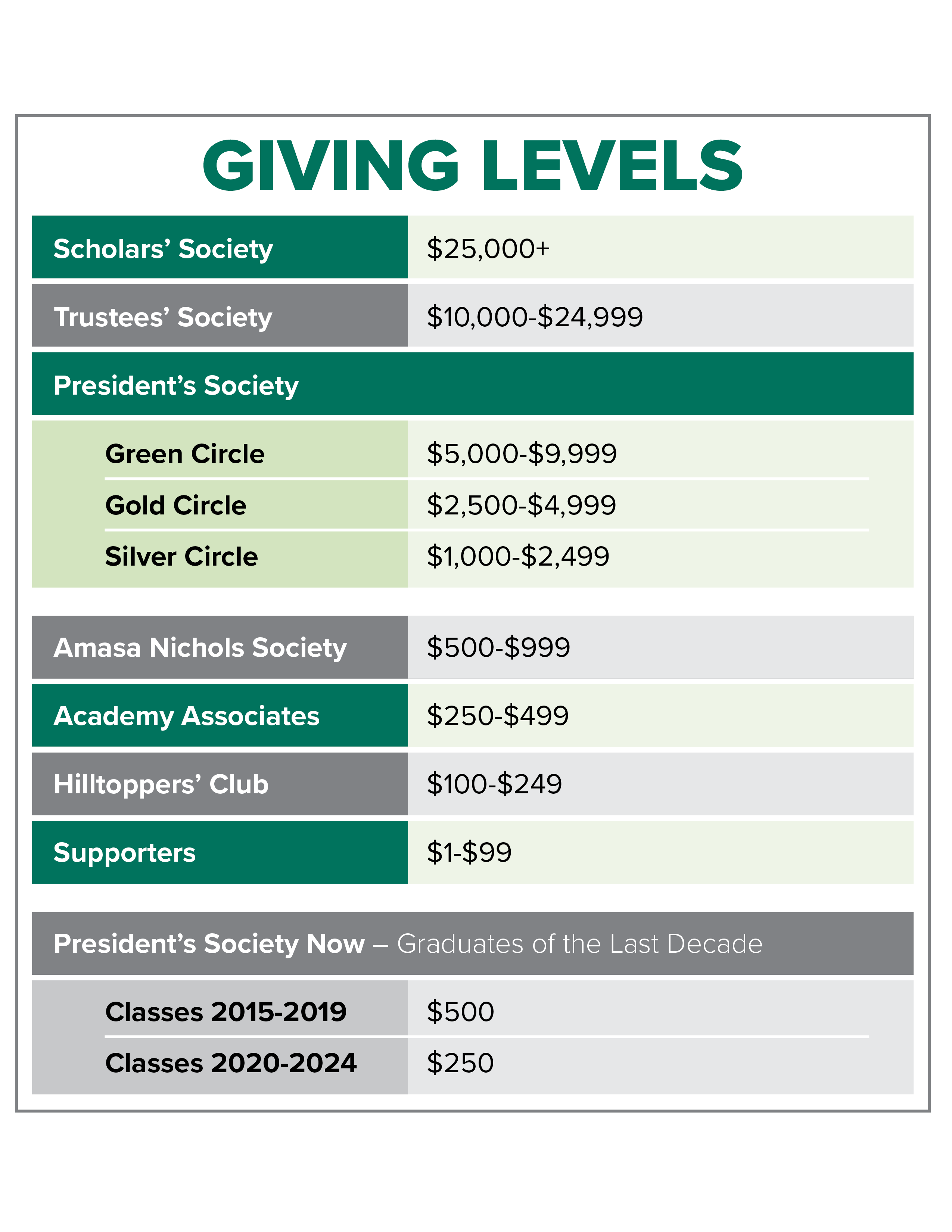

Recurring giving also allows you to make your yearly contribution at a leadership level, including participation in the President’s Society, because your gift is divided into more manageable monthly or quarterly increments. Amounts may need to be adjusted during the first year if enrollment begins after July to ensure the desired giving level is achieved. The College’s fiscal year is July 1 – June 30.

How can you participate in the program?

By Credit Card: For recurring gifts made via credit card, visit our secure giving page and select “Become a Sustainer today. Make this a recurring gift.” Get started by clicking here: Make a Recurring Gift Today.

A record of each gift will appear on your bank or credit card statement, and you will receive an annual receipt from the College each January for your tax records.

Questions?

If you have questions or would like to increase, decrease or terminate your recurring gift, please call 1-866-622-4766 or email advancement@nichols.edu.

Please remember to contact the College when you close accounts, change banks or get an updated expiration date for your credit card. Thank you for your support of this great institution.

Supporting Bison Athletics for Today and Tomorrow

The Bison Club offers six membership levels, starting at $100 ($50 for graduates of the last 10 years), which include exciting membership benefits. Click here to join the Bison Club today. We appreciate your support!

Matching gifts are excellent ways to leverage your giving to Nichols. Many companies match the charitable contributions of employees, spouses of employees, retirees or board members. If you have any questions, please contact the Office of Advancement by email or at 866-622-4766.

Gifts of stock are a wonderful way to support Nichols and provide you with both income and capital gains tax deductions.

To make a gift of stock to Nichols College, please ask your broker to wire transfer your stock to the Nichols College account at Wells Fargo Advisors, using these instructions:

Digital Transfer Code: First Clearing LLC

DTC #141

Client Acct. Number: Please call us for this information

Client Name: Nichols College

In some cases, due to privacy laws, brokerage firms will not release the name of the donor who initiated the transfer. Therefore, if order to properly credit your donation, please contact Susan Veshi, interim vice president for advancement, prior to making a donation to inform us of the name of the stock, as well as number of shares and how you would like the gift to be used. We will provide you the account and DTC numbers. Susan can be reached at susan.veshi@nichols.edu or 866-622-4766.

Once again, we thank you for counting Nichols College among the beneficiaries of your charitable giving, and for your commitment to Nichols and to the future leaders we serve.

Leaving an estate gift is one of the more personal and effective ways donors can make a difference in the life of Nichols College. Your bequest can help create endowed scholarships and professorships or revitalize the campus with new and renovated facilities.

For more information about planned giving and donors stories, click here.

For questions or sample bequest language please email plannedgiving@nichols.edu or call 508-213-2211.

If you are looking to make a non-deductible donation to charity, you may want to consider a QCD.

The IRA Qualified Charitable Distribution (QCD) allows individuals age 70½ or older to make an outright gift of as much as $100,000 annually to Nichols College from a traditional IRA. The withdrawal amount may count toward your annual required minimum distribution (RMD). Although the RMD is not required until age 73, the QCD can be particularly beneficial for donors who do not itemize and instead file the standard deduction.

A QCD is a direct transfer of funds from your IRA, payable directly to a qualified charity, as described in the QCD provision in the Internal Revenue Code. Amounts distributed as a QCD can be counted toward satisfying your RMD for the year, up to $100,000. The QCD is excluded from your taxable income. This is not the case with a regular withdrawal from an IRA, even if you use the money to make a charitable contribution later on. If you take a withdrawal, the funds would be counted as taxable income even if you later offset that income with the charitable contribution deduction.

Why is this distinction important? If you take the RMD as income, instead of as a QCD, your RMD will count as taxable income. This additional taxable income may push you into a higher tax bracket and may also reduce your eligibility for certain tax credits and deductions. To eliminate or reduce the impact of RMD income, charitably inclined investors may want to consider making a qualified charitable distribution (QCD). For example, your taxable income helps determine the amount of your Social Security benefits that are subject to taxes. Keeping your taxable income level lower may also help reduce your potential exposure to the Medicare surtax.

For more information, consult with your tax advisor.

What is a DAF?

An Effective Way to Give

A donor-advised fund (DAF) is a centralized charitable account. It allows charitably-inclined individuals, families and businesses to make tax-deductible charitable donations of cash, publicly-traded stock and in some case, certain illiquid assets, to a public charity that sponsors a DAF program.

A DAF is a centralized vehicle for charitable giving that makes it easy for donors to dedicate funds to support their favorite nonprofit organization. It also provides an operationally convenient and tax-efficient method for donors to manage their charitable giving.

With a DAF, charitably inclined individuals, families, and businesses make an irrevocable gift to a public charity that sponsors a donor-advised fund program and may take an immediate tax deduction. Donors can then recommend grants over time to IRS-qualified 501(c)(3) public charities. DAFs also allow donors to approach their charitable giving thoughtfully by involving other family members or colleagues in their philanthropic decisions. Most DAFs accept donations of long-term appreciated securities and other assets, and donors can advise how the funds are invested, which could potentially allow tax-free growth, and could result in more money for your charity.

Faculty and staff giving is more important than you may realize. Many grant-making organizations, such as private foundations, use faculty and staff giving participation rates as a gauge for their own funding to colleges and universities and participation rates also factor into popular campus rankings and the college’s overall reputation. A high faculty/staff giving percentage is an endorsement by employees that the College is a worthy place to work for and deserving of their financial investment. The added bonus is that you are really helping the students, allowing them to focus on their classwork rather than their debt.

We are ON THE MOVE and have you, along with alumni, parents, and friends, to thank for that. Faculty and staff giving demonstrates that Nichols is one of the best investments for a potential donor’s philanthropic support. When we give, we inspire others to give as well.

Remember, it isn’t the amount of your gift, but your participation that counts. Even $1 per pay period makes a difference.

Please click here to access the online payroll deduction form.